Updated · Feb 11, 2024

Updated · Jan 02, 2024

Sirisha is a networking enthusiast with a bachelor's degree in computer science and engineering. She... | See full bio

April is a proficient content writer with a knack for research and communication. With a keen eye fo... | See full bio

It's fair to say that HBO's success did not occur overnight. HBO, launched in 1972, is one of the best established American pay-TV networks, thanks to WarnerMedia Studios & Networks. Being one of the oldest pay-TV networks in the US has contributed to HBO revenue growth and reputation. In addition, Spanish speakers in the US can also enjoy HBO Latino (in Spanish), making the TV network one of the most versatile in the US.

So how did the premium television network manage to grow steadily despite the competition and become one of WarnerMedia's most profitable assets? Consider the following HBO statistics to understand its reach and revenue model.

HBO users have tuned in to the Home Box Office (HBO) since November 1972. So in almost half a century, the TV network has learned how to shine.

The pay-TV network has needed to evolve and reach out to new audience groups to grow HBO subscription numbers over the years. Consider the following stats to see how HBO has remained relevant.

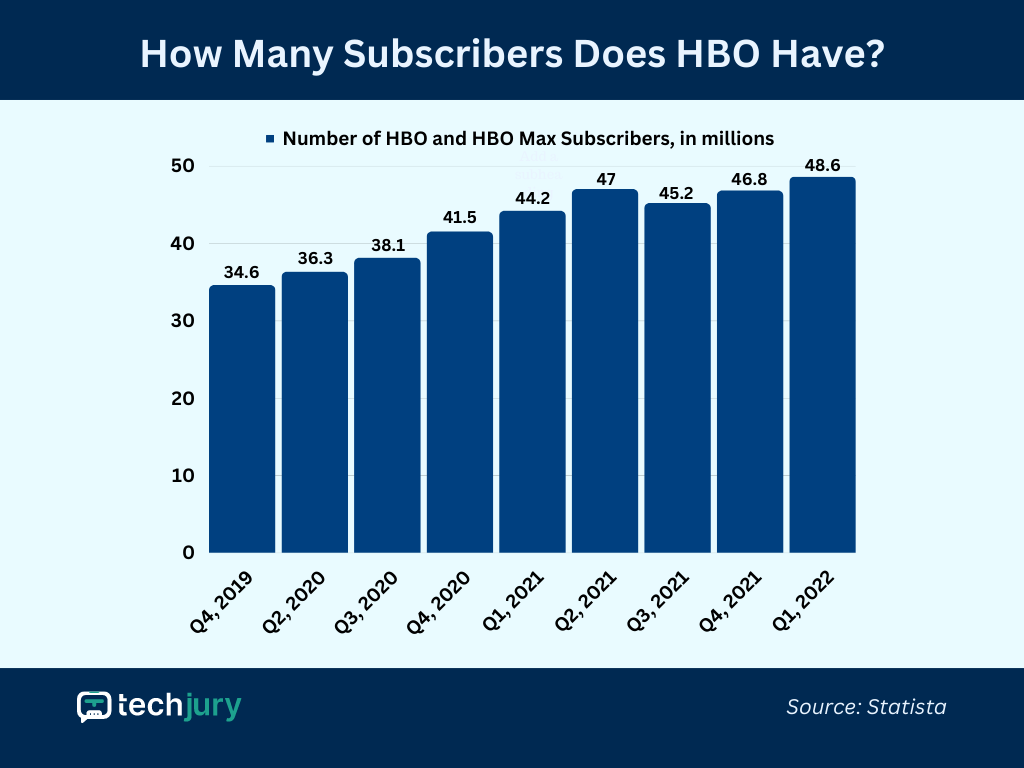

(Statista)

The number of subscribers in the fourth quarter of 2021 was 46.8 million compared to 41.5 million in the previous year.

| Year | Number of HBO and HBO Max Subscribers, in millions |

| Q4, 2019 | 34.6 |

| Q2, 2020 | 36.3 |

| Q3, 2020 | 38.1 |

| Q4, 2020 | 41.5 |

| Q1, 2021 | 44.2 |

| Q2, 2021 | 47 |

| Q3, 2021 | 45.2 |

| Q4, 2021 | 46.8 |

| Q1, 2022 | 48.6 |

Not every pay-TV network has managed to create a successful presence. Note the following 14 most significant HBO stats that highlight its reach.

HBO is not just a premium cable network. Users can also subscribe to HBO Now for over-the-top (OTT) video services. HBO Max (formerly HBO Now) - primarily designed to compete with Netflix and Hulu - comes as a separate service with a unique set of programs, including Game of Thrones.

(DMR)

One of the most meaningful HBO statistics includes the geographic range covered by the network. Subscribers can follow their favorite program in 150 countries. HBO Max subscribers are more likely to reach out to the platform to catch up on new programs abroad.

(DMR)

Quality is at the heart of HBO’s success. As of 2017, the network counted 111 HBO Primetime Emmy nominations. In 2019, HBO received nearly 140 Primetime Emmy nominations—a testimony of the quality of its content, which keeps users engaged.

You don’t stay in business for almost 50 years as a premium TV network without knowing a few tricks on how to drive revenue growth.

(Statista)

HBO earns money in various ways, including subscription options, content licensing to other networks, selling merchandise, and advertising. But in 2021, subscriptions alone accounted for $7.7 billion in revenue. Viewers who discovered Game of Thrones, for example, would have contributed to the revenue via subscription, watching on a different network, or purchasing merchandise.

(DRM)

In addition to Warner Bros. Entertainment Inc, HBO is one of WarnerMedia’s most successful assets, contributing to 1/5 of Warner’s overall revenue—remarkable for a 50-year-old pay-TV network.

(Wikipedia)

After all essential expenses, HBO’s operating income amounts to approximately $2 billion.

(Deadline)

Subscribers are keen to stay with the network due to the content quality. In the US, the average revenue per subscriber is $11.15. When you consider the over 45 million subscribers, it’s easy to understand the impact of the network.

HBO demographics reflect the digital move to appeal to new subscribers.

(Digital in the round)

HBO stats show that American subscribers aged 65+ have never heard of digital subscriptions, HBO Go, or HBO Max (HBO Now). HBO needs to promote service diversity and help seniors move to their more recent platforms to maintain engagement and growth as the population ages.

(Digital in the round)

HBO fails to appeal to young viewers despite targeting a young audience via app downloads and streaming. Price is likely the issue, as only Millennials—who are tech-savvy and have extra income—state they would probably purchase an HBO Max subscription, with 8% stating they would be very likely to buy a subscription. Boomers—and nearly 30% of Generation Z—are unlikely to purchase a subscription.

(Digital in the round)

With almost 87,000 new users downloading HBO Max on their smartphones and an average of 16,000 HBO Now app downloads per day, there’s no doubt that many HBO users in 2022 will watch TV on their phones. (HBO reaches out to new audience groups via free app trials.)

HBO subscribers are a diverse and eclectic audience.

(Statista)

HBO launched its Spanish language service to address the Latino community in the US and South America. HBO accounts for over 140 million global users, including over 45 million in the US. Naturally, users will have different content expectations and needs.

Investments and efforts toward new and engaging content—such as Game of Thrones featuring a primarily British cast—are also aimed at a broad audience.

(Digital in the round)

Unfortunately, one of the main disadvantages of creating and promoting unique content is that subscribers select their network service to access a specific type of content. Approximately one in five users say they would stop their subscription if a particular program ended.

(Digital in the round)

Reaching new users digitally is a double-edged sword. While HBO can become more visible to remote audience groups, it can also be affected by the smartphone-app economy. Viewers are not willing to pay typical subscription costs to watch content on their phones.

HBO statistics reflect a forward-thinking network constantly pushing the boundaries of content and media infrastructure. It’s no wonder that HBO remains relevant as one of the oldest pay-TV networks due to market understanding and constant content improvements. Yet, relying on digital technology also creates a divide between generations of viewers in terms of technology access and income availability.

Many smartphone users are unwilling to pay to watch their favorite programs online, while many who have extra income are not aware of the digital services. We can only wait for HBO’s next move to appeal more to Generation Z and Boomers.

Your email address will not be published.

Updated · Feb 11, 2024

Updated · Feb 11, 2024

Updated · Feb 08, 2024

Updated · Feb 05, 2024